*Note: Name, Email and Phone Number are mandatory.

Summary:

Africa’s manufacturing ecosystem is entering a phase defined by execution-ready industrial platforms, rising regional demand and integrated infrastructure. In 2025, capacity expansion accelerated across textiles, agro-processing, construction materials, automotive and pharmaceuticals, supported by SEZ-led development and infrastructure investment. Trade integration, improving power reliability and logistics upgrades are enabling manufacturers to serve multiple markets from fewer production bases. As consumer demand deepens and sector-specific hubs emerge, manufacturing decisions across Africa are increasingly shifting from approvals to on-ground scale.

Table of Contents:

1. Macroeconomic Tailwinds Reshaping the Global Investment Map

2. Industrial Momentum and Capacity Formation

3. Capital Aligned with Structure

4. Trade and Infrastructure as Enablers

5. Rising Consumer Purchasing Power

6. Nigeria: From Growth Projections to Strategic Execution

7. Sector Signals Shaping Manufacturing Activity

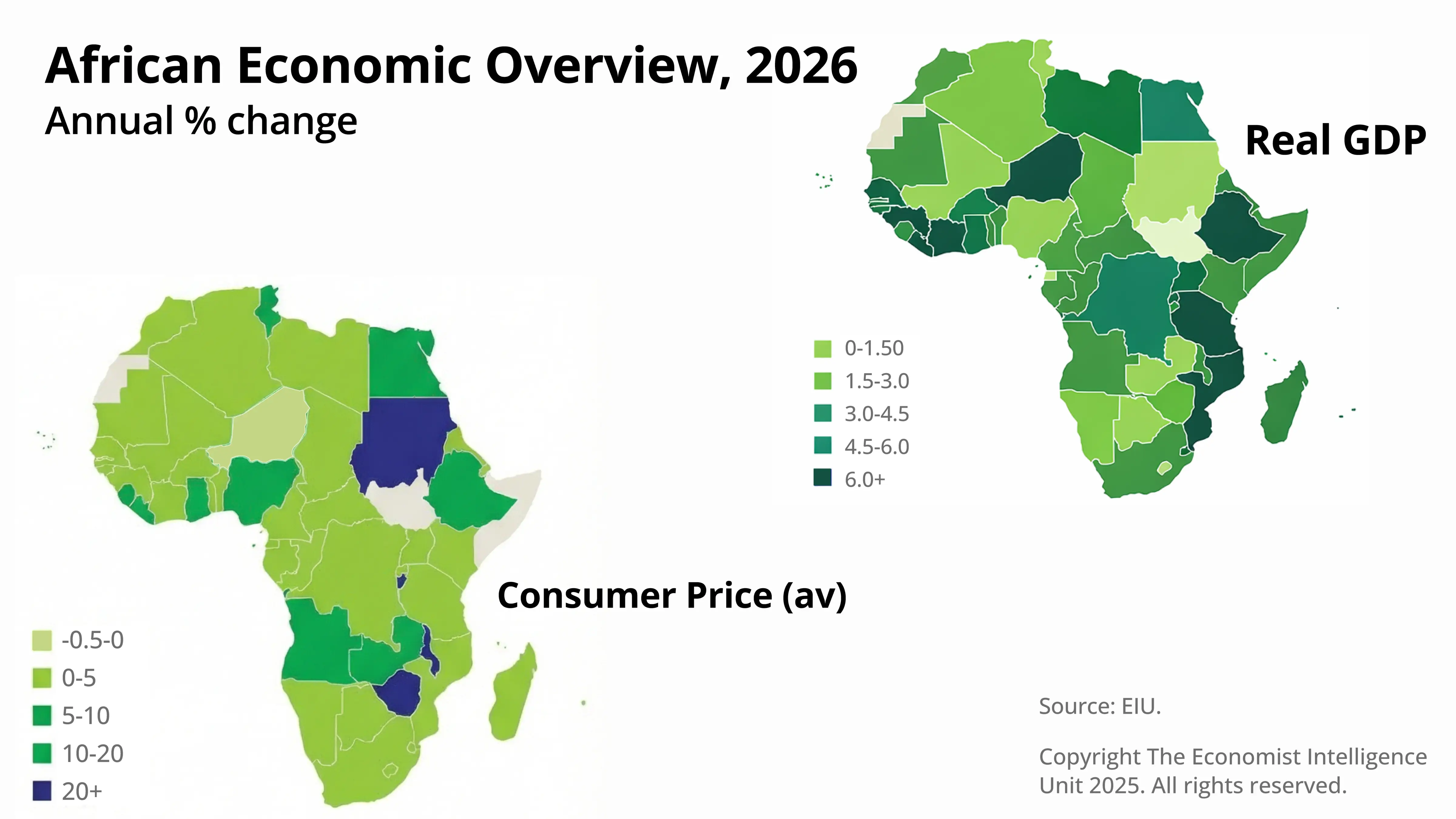

Sub-Saharan Africa is projected to grow at 4.4% in 2026, outpacing Asia’s 4.1%, as China navigates structural adjustments and demographic shifts. According to IMF projections, 11 of the world’s 15 fastest-growing economies in 2026 will be African a signal that global growth gravity is continuing to shift.

This acceleration is being driven by a combination of structural and cyclical forces:

Together, these dynamics are strengthening Africa’s position as a long-term manufacturing and industrial growth frontier.

Several African economies ranked among the fastest-growing globally, with GDP growth ranging from approximately 6% to over 20% across countries such as South Sudan, Senegal, Uganda, Rwanda, Benin, Ethiopia, Tanzania and Côte d’Ivoire. Growth was supported by activity across infrastructure, manufacturing, energy, agriculture, and public investment.

For manufacturing, this growth translated into measurable capacity movement. Industrial zones reported higher factory occupancy, new production lines became operational and a growing share of manufacturing investment shifted from approvals to on-ground execution. Expansion activity was visible across textiles and apparel, agro-processing, construction materials, automotive assembly, and pharmaceuticals, particularly in locations where infrastructure readiness and logistics access had improved.

What stands out is the increasing concentration of activity within integrated industrial platforms, reducing setup timelines and enabling faster scale.

Across COMESA countries, announced greenfield projects were led by renewable energy and large-scale construction, supporting industrial reliability rather than short-term cost advantages (COMESA–UNCTAD Investment Report).

Egypt recorded over USD 77 billion in mega construction investments, while foreign investment into the construction sector across the region increased sharply (UNCTAD).

Financing activity also supported special economic zones focused on manufacturing, agro-processing, and export-oriented industries, including Magwero Industrial Park (Malawi), GDIZ (Benin), PIA (Togo), and GSEZ (Gabon). Large private transactions, including Vision Invest joining Africa Finance Corporation (AFC) as a shareholder in Arise IIP, reinforced confidence in integrated development models.

Taken together, these patterns indicate a shift away from standalone facilities toward integrated platforms combining infrastructure, power, logistics, and industrial real estate.

Trade and infrastructure are increasingly influencing how manufacturing systems function across Africa, particularly in terms of reliability, reach and speed. Rising intra-African trade reflects this shift and growth in cross-border flows such as the sharp increase in Kenya’s exports to Rwanda signals stronger regional linkages, allowing manufacturers to serve multiple markets from fewer production bases.

At the same time, investments in power, ports and transport infrastructure are changing operational conditions on the ground. Expanded renewable energy capacity within industrial corridors has improved power reliability, while port upgrades in Lomé and Mombasa have reduced turnaround times.

Even aviation projects, including Rwanda’s Bugesera International Airport, Ethiopia’s planned Bishoftu Airport, and Morocco’s Airports 2030 programme, are strengthening cargo connectivity across regions.

Together, these developments reduce friction across supply chains, making it easier for manufacturers to coordinate production, distribution and scale across markets.

Consumer demand is increasingly shaping how manufacturing capacity is planned and located across Africa.

Household consumption accounts for over 60% of GDP, supported by a young, urbanising population and expanding retail access. Spending growth has been particularly visible across food products, apparel, healthcare, construction inputs, and mobility, with preventive healthcare, wellness, and fitness emerging as fast-growing categories.

At the same time, digital adoption is changing purchasing behaviour. Africa processes approximately USD 1.1 trillion in mobile-money transactions annually, accelerating the shift from cash to wallets, cards, and QR-based payments. Credit penetration among younger consumers is rising, supporting more consistent demand for manufactured goods.

Together, these dynamics are pulling production closer to consumption centres, strengthening the case for local and regional manufacturing rather than import-led supply.

The latest data highlighted around WEF26 points to a global growth upgrade to 3.3%, alongside a 4.4% growth projection for Nigeria. While these figures reflect resilience, they also underscore a deeper strategic imperative: growth on paper must translate into productive capacity on the ground.

At the Galadiman Ruwa Centre for Strategic Leadership and Communication (GCSLC), analysis suggests that meeting these targets requires more than managing existing flows. It demands a fundamental restructuring and re-engineering of under-utilised national assets.

| Sector | What’s Scaling | Manufacturing Impact |

| Textiles & Apparel | Integrated cotton-to-garment ecosystems | Supports vertical integration and export competitiveness |

| Agro-Processing | Multi-crop processing platforms | Captures more value from locally produced crops |

| Construction Materials | Steel, cement, ceramics linked to infrastructure pipelines | Reduces logistics-heavy costs in infrastructure-led demand |

| Automotive & E-Mobility | Components and mobility inputs | Fits Africa’s strengths in component manufacturing |

| Pharmaceuticals | Essential medicines and OTC production | Improves regional supply security |

Manufacturing activity across Africa is increasingly concentrating around defined regional hubs where infrastructure readiness, sector depth, and demand conditions align. Automotive and green mobility clusters in Kenya and Rwanda, integrated textile ecosystems in Benin and Togo, large-scale garment manufacturing in Nigeria and value-added wood processing in Gabon illustrate how production is organising spatially rather than dispersing evenly.

The emergence of these hubs reflects the development of broader manufacturing systems, linking infrastructure readiness, sector depth, and regional demand.

1. How is manufacturing speeding up in Africa?

Manufacturing growth is accelerating due to the convergence of three shifts: macroeconomic stabilisation, operational digitisation, improving industrial infrastructure, and changes in how manufacturing capital is being deployed. Together, these factors are shortening planning cycles and making manufacturing more feasible within a defined time horizon.

2. Is Manufacturing a good investment in Africa?

Manufacturing investment in Africa is gaining traction as the continent enters a period of faster growth and improving execution conditions. In 2026, momentum is expected to be strongest in East and West Africa, supported by easing inflation, regional trade integration, digital adoption, and sustained foreign direct investment.

3. What are the fastest growing manufacturing industries in Africa?

Manufacturing growth in Africa is concentrated in textiles and apparel, agro-processing, automotive components and mobility inputs, and light industrial and building materials. These industries are scaling because they combine strong demand with improving logistics, trade access, and operating reliability.

4. Why does 2026 matter specifically for Africa’s manufacturing landscape?

2026 functions as a planning and execution reference point, rather than a fixed forecast. It reflects the period by which current structural improvements—across infrastructure, logistics, and investment frameworks—begin to translate into operating manufacturing capacity, shaping where early advantage is established.

5. Which manufacturing sectors are best positioned to benefit from this execution phase?

Sectors gaining momentum are those aligned with Africa’s current execution strengths, including textiles and apparel, food and agro-processing, automotive components, and light industrial and building materials. These sectors are advancing because they can scale without requiring fully mature manufacturing ecosystems.

6. How does execution readiness differ across regions in Africa?

Execution readiness is uneven and highly location specific. East and West Africa are emerging with distinct manufacturing roles shaped by differences in trade connectivity, logistics infrastructure, and operating scale. Interpreting the outlook requires understanding these regional operating dynamics rather than applying a uniform continental lens.

Africa’s manufacturing ecosystem is moving into a phase defined by operational platforms, regional demand, and execution-ready industrial zones. From integrated Special Economic Zones to sector-specific manufacturing hubs, the conditions for scale are increasingly in place.

Connect with AFI’s investment specialists to explore manufacturing opportunities aligned with your sector, location strategy, and growth objectives.

Get in touch with our Africa investment specialists or support team to begin your manufacturing journey in Africa.

recommended topics

Discover prime locations across Africa for lucrative investment opportunities and strategic growth.

Explore key investment zones in Africa that offer strategic advantages and economic benefits.

Uncover the best investment opportunities in Africa to maximize your business potential.

Identify the most promising sectors in Africa for high returns and sustainable investments.

Compare

Dear investor, please compare similar category items- either Locations or Opportunities.

*Already subscribed.

*Enter your name/email.

Sign up for exclusive investment alerts.

Already subscribed? Skip

Thank You For Subscribing to

Africa For Investors.

You will be redirected to AFI’s Linkedin Profile in 10 seconds.

Stay On AFI Website