Industry Overview

→ Why is GDIZ a strategic destination for investors?

GDIZ offers a fully serviced industrial ecosystem with plug-and-play facilities, stable utilities, logistics integration, and access to Cotonou Port. The zone supports multiple value chain textiles, agro-processing, cosmetics, packaging, and light manufacturing enabling investors to operate with lower entry risk and faster time to market.

→ Which industries are currently active at GDIZ?

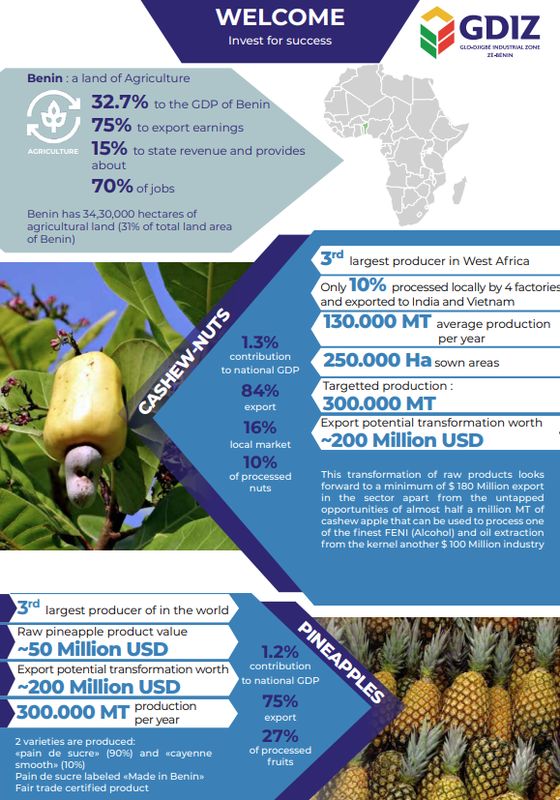

Operational units span textiles & apparel, cashew processing, cosmetics, packaging, wood products, and light manufacturing. International brands source finished goods from the zone, demonstrating compliance with global standards and export readiness.

Profitability & Value Chain Opportunities

→ What value-addition opportunities exist at GDIZ?

Investors can integrate backward and forward across multiple chains from raw material processing (cotton, cashew, timber) to finished goods (garments, cosmetics, packaging). This structure improves margins, reduces import dependency, and enhances operational efficiency.

→ How does GDIZ’s integrated ecosystem improve profitability?

With ready-built facilities, reliable utilities, efficient port access, and streamlined regulation, GDIZ lowers setup costs and reduces operational friction. Investors benefit from predictable lead times, high uptime, and sector-specific clusters that improve productivity and scalability.

Market Trends & Demand Evolution

→ Which global buyers source products from GDIZ?

European and US retailers procure garments, processed cashews, cosmetics, and packaging materials from GDIZ. Shorter lead times to Europe and strong compliance frameworks enhance competitiveness versus traditional sourcing hubs.

→ How does GDIZ align with global sustainability expectations?

The zone incorporates renewable energy, water treatment systems, traceability frameworks, and responsible sourcing practices (e.g., CMiA cotton, certified cashew). This supports investors seeking to meet ESG, traceability, and ethical production requirements.

Africa Industry Insights

→ What competitive advantages does GDIZ offer compared to other African zones?

GDIZ combines proximity to Cotonou Port, competitive operating costs, multi-sector integration, and a public–private operational model. This creates a more predictable and efficient environment compared to zones with fragmented infrastructure or limited regulatory integration.

→ How is GDIZ contributing to regional industrial capacity and workforce development?

Through dedicated training centers and sector-focused academies, GDIZ develops skilled labor in garmenting, agro-processing, manufacturing, and quality control supporting long-term industrial competitiveness and job creation.

Geo Comparision

→ How does GDIZ compare with Asian manufacturing hubs?

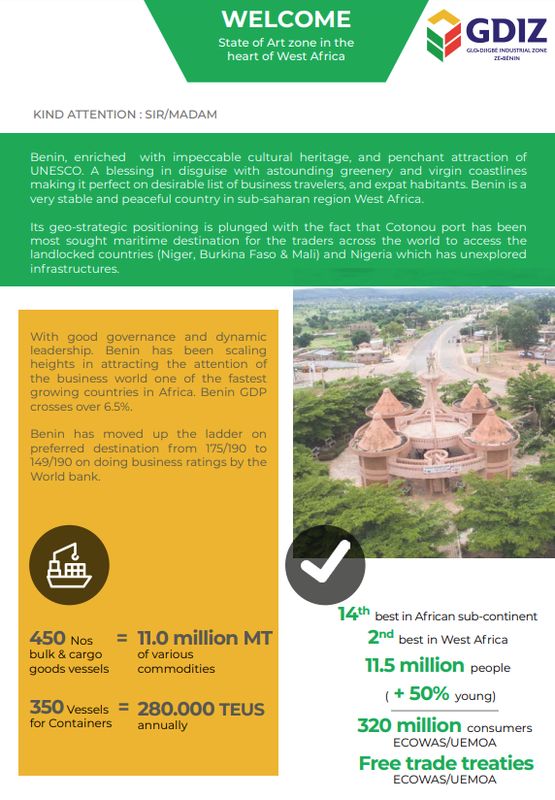

GDIZ offers preferential EU/US market access (EPA/GSP/AfCFTA), competitive labour, shorter transit times to Europe, and vertically integrated value chains. These factors provide a viable “China+1/Africa+1” sourcing alternative with tariff and freight advantages.

→ What makes GDIZ’s location advantageous within West Africa?

Located just 45km from Cotonou Port and along major ECOWAS trade corridors, GDIZ provides efficient access to regional markets and fast export connectivity, reducing logistics time and cost.

Industrial Zones & Setup Benefits

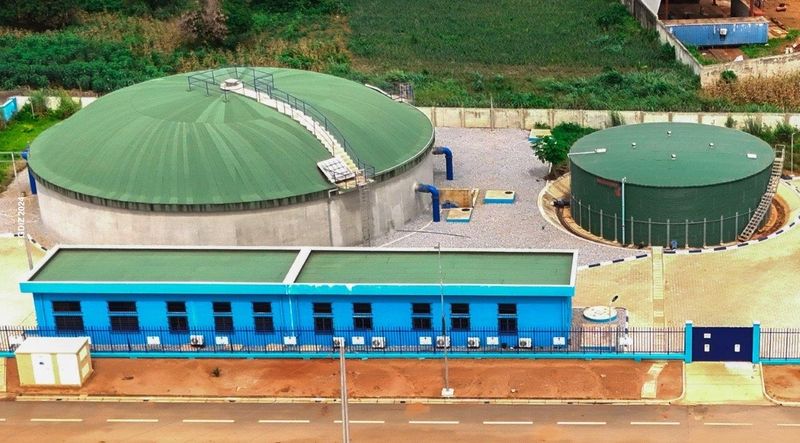

→ What infrastructure supports manufacturing at GDIZ?

The zone offers ready-built factories, warehousing, reliable power and water, internal roads, digitised single-window services, and sector-specific clusters enabling investors to begin production rapidly with minimal setup friction.

→ How does GDIZ’s development model reduce risk for investors?

Built by ARISE IIP under a public–private partnership, GDIZ features predictable timelines, strong governance, investor facilitation, and scalable infrastructure. This model has proven replicable across multiple African zones, offering greater reliability and long-term stability.