Industry Overview

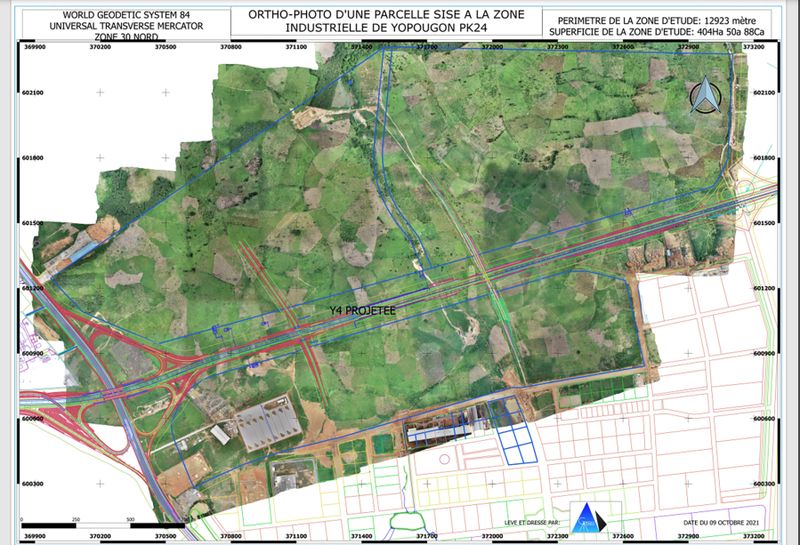

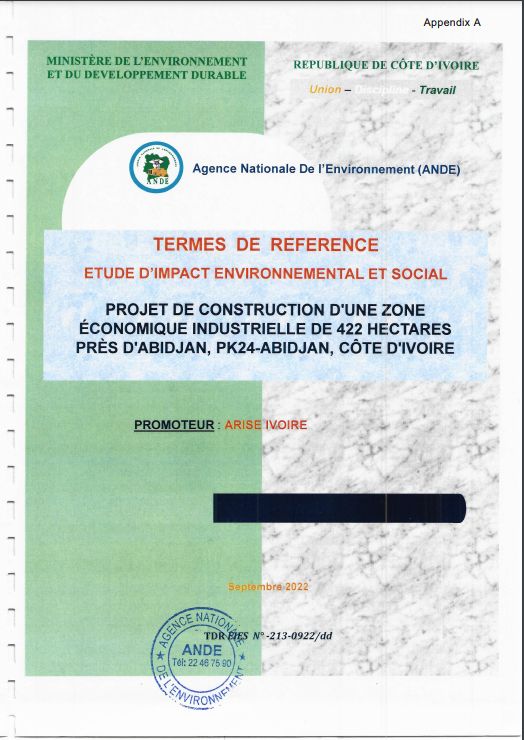

→ What is PEIA and why is it strategically important?

PEIA is a government-backed industrial zone offering plug-and-play infrastructure, simplified setup support, and direct access to Abidjan’s logistics ecosystem reducing entry barriers for export-focused manufacturers.

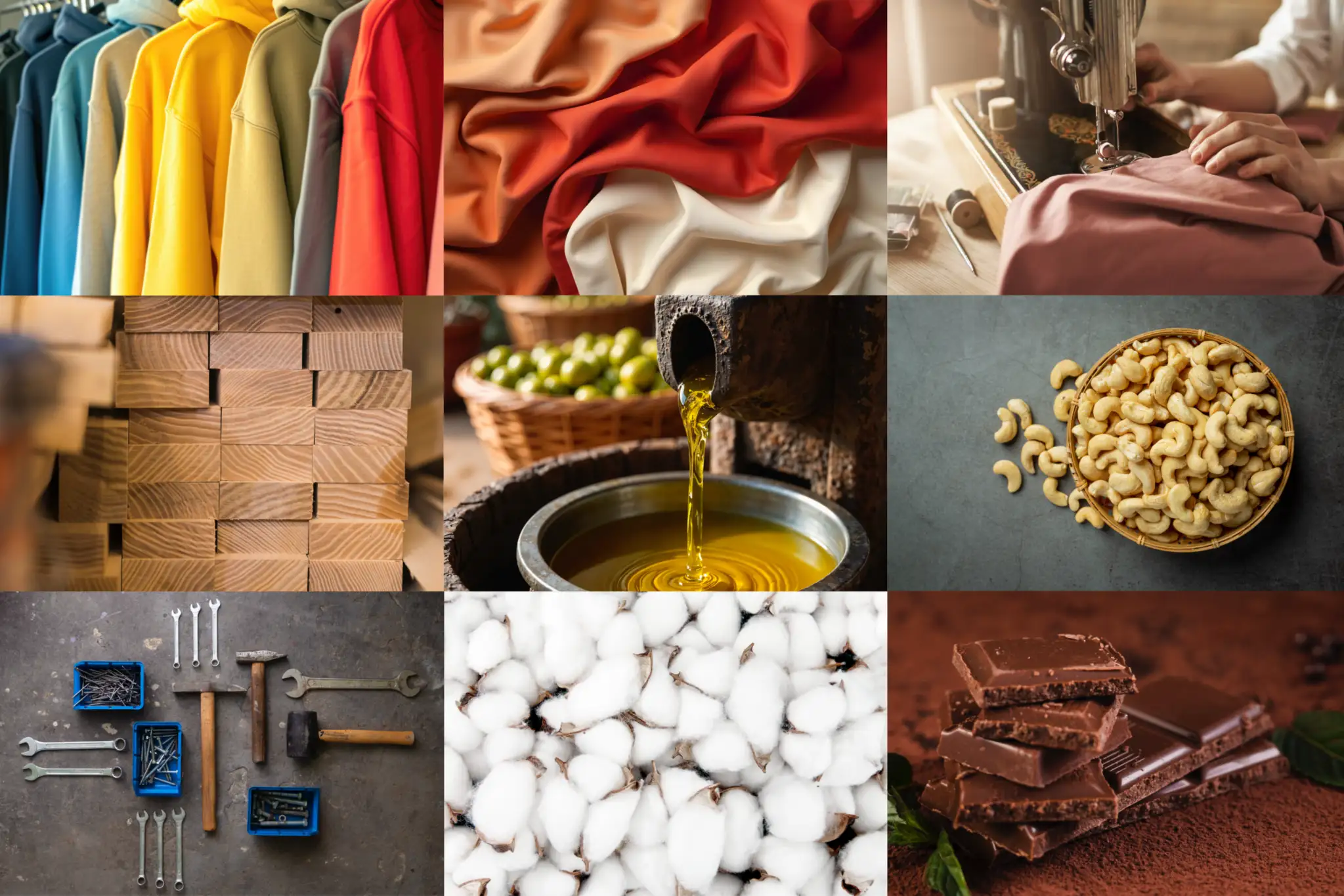

→ Which industries does PEIA prioritise?

Agro-processing, light manufacturing, textiles, FMCG, construction materials, and packaging sectors aligned with Côte d’Ivoire’s raw material strengths and AFI’s zone development capabilities.

Profitability & Value Chain Opportunities

→ How does PEIA support investor profitability?

Competitive utilities, pre-serviced plots, and predictable logistics lower operating costs and reduce commissioning timelines, improving margin potential.

→ What value chain opportunities does PEIA enable?

The zone’s proximity to agricultural and industrial input clusters allows investors to build integrated value chains from sourcing to processing to finished goods reducing import dependence and improving cost efficiency.

Market Trends & Demand Evolution

→ How is PEIA aligned with global manufacturing shifts?

As brands diversify supply chains beyond Asia, PEIA provides an alternative location with improving infrastructure, reliable operations, and a predictable export pathway into ECOWAS, EU, and US markets.

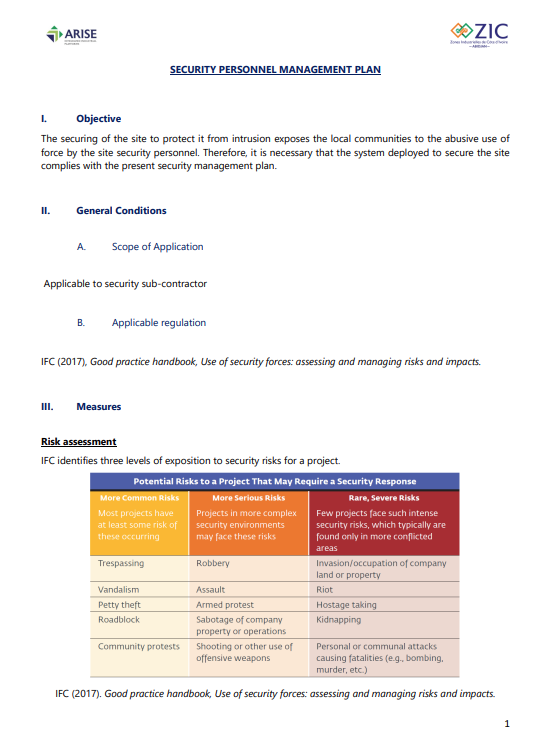

→ How does PEIA support sustainability expectations?

PEIA incorporates structured waste systems, efficient utilities, and compliance-ready facilities that help manufacturers align with ESG, audit, and traceability requirements.

Africa Industry Insights

→ How does Côte d’Ivoire’s economic environment support investment at PEIA?

Sustained GDP growth, controlled inflation, and ongoing business-environment reforms position Côte d’Ivoire as one of West Africa’s more stable and investment-friendly economies.

→ What institutional support strengthens PEIA’s reliability?

The zone benefits from public–private governance, single-window facilitation, and support from development partners ensuring clear processes and long-term operational continuity.

Geo Comparision

→ What makes PEIA geographically competitive?

Immediate proximity to the Port of Abidjan, the region’s busiest deep-sea port, enables faster exports, shorter lead times, and dependable global shipping routes.

→ How does PEIA compare with other West African zones?

PEIA offers cost-efficient operations, predictable utilities, and stronger logistics reliability than many neighbouring zones, making it a more consistent base for scale.

Industrial Zones & Setup Benefits

→ What setup advantages does PEIA offer?

Ready industrial plots, reliable utilities, internal road networks, and single-window administrative support that streamline setup and reduce delays.

→ How does phased development enhance investor confidence?

Phased infrastructure rollout ensures land availability, clear expansion timelines, and long-term visibility for investors planning multi-stage growth.