$31,791.4 Mn

Market Size

3.9%

CAGR

$41,637.3 Mn

Forecast

*Note: Name, Email and Phone Number are mandatory.

As the global focus on sustainability intensifies and demand for recycled metals increases, the metal recycling industry in Africa emerges as a compelling investment opportunity. Africa's rich mineral resources, coupled with its growing population and urbanization, create a fertile ground for a thriving metal recycling sector.

As the global focus on sustainability intensifies and demand for recycled metals increases, the metal recycling industry in Africa emerges as a compelling investment opportunity. Africa's rich mineral resources, coupled with its growing population and urbanization, create a fertile ground for a thriving metal recycling sector.

$31,791.4 Mn

Market Size

3.9%

CAGR

$41,637.3 Mn

Forecast

Recycled Aluminum Sheets

Recycled Steel Bars

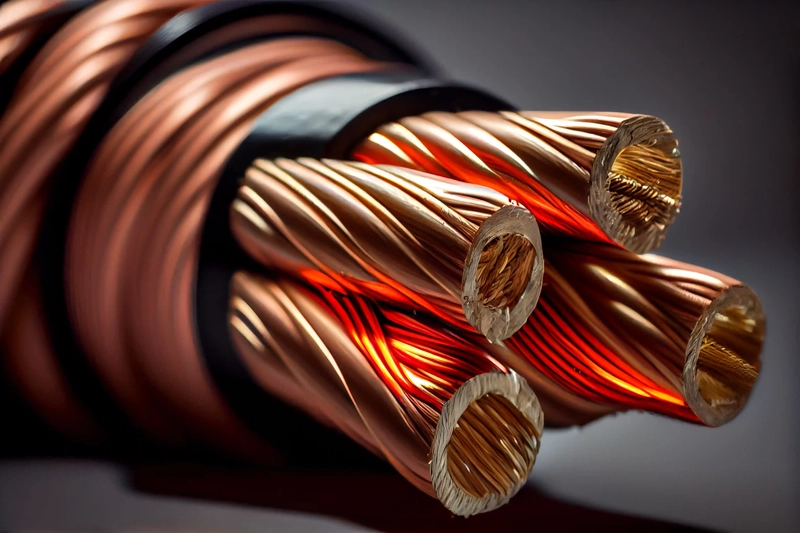

Copper Wiring

Scrap Metal for Construction

Aluminum Cans

Metal Packaging Materials

$1 Bn

Estimated Export Value

$5 Bn

Forecasted to grow by 2030

Growing Demand for Recycled Metals: The demand for recycled metals is surging globally due to rising prices of virgin materials and a shift towards sustainable practices, making investment in this sector highly lucrative.

Diverse Metal Waste Sources: Africa produces a vast amount of scrap metal from industries such as construction, automotive, and electronics, providing a consistent supply for recycling operations.

Government Support and Policies: Numerous African governments are implementing policies that encourage recycling through tax incentives, grants, and favorable regulations, creating a conducive investment environment.

Increasing Urbanization: Rapid urbanization across Africa is leading to greater metal waste generation, offering opportunities for recycling facilities to cater to urban centers.

Growing Middle Class: An expanding middle class in Africa is driving consumer demand for products made from recycled metals, further boosting the market.

What are the primary metals recycled in Africa?

The primary metals recycled in Africa include aluminum, copper, steel, and lead. Aluminum is particularly prominent due to its extensive use in packaging and transportation, while copper is often sourced from electrical and electronic waste.

How does the regulatory environment affect metal recycling investments?

The regulatory environment plays a crucial role in shaping investment strategies. Many African countries are implementing stricter regulations to promote recycling and reduce environmental impact. Understanding local laws, permits, and compliance requirements is essential for successful investments.

What are the initial capital requirements for starting a metal recycling business in Africa?

Initial capital requirements can vary widely based on the scale of operations and location. On average, investors may need between $50,000 to $250,000 for small to medium-sized recycling facilities, considering equipment, labor, and operational costs.

What technologies are currently being utilized in Africa’s recycling sector?

Technologies such as shredders, balers, and advanced sorting systems are commonly used in Africa’s recycling sector. Innovations like automated sorting and energy-efficient smelting processes are gaining traction, enhancing efficiency and reducing operational costs.

How do global market trends impact Africa’s metal recycling industry?

Global trends, such as the increasing demand for sustainable products and the volatility of raw material prices, significantly influence Africa’s recycling industry. Investors should stay informed about international market dynamics to align their strategies accordingly.

What are the risks associated with investing in metal recycling in Africa?

Key risks include regulatory changes, market volatility, and logistical challenges. Additionally, there may be concerns regarding the quality and consistency of recycled materials. Conducting thorough market research and risk assessments can help mitigate these challenges.

How can investors ensure compliance with environmental regulations?

Investors can ensure compliance by staying updated on local environmental laws and implementing best practices in waste management and recycling processes. Engaging local experts and legal advisors can also aid in navigating regulatory landscapes.

Are there any successful case studies of metal recycling businesses in Africa?

Yes, several businesses have successfully scaled their operations, such as "Enviroserve" in Kenya, which focuses on electronic waste recycling, and "African Recyclers" in Nigeria, which has become a leading player in plastic and metal recycling.

What is the expected return on investment for metal recycling ventures in Africa?

The expected ROI in the metal recycling sector can range from 15% to 30%, depending on various factors such as location, operational efficiency, and market conditions. A well-planned strategy can optimize returns and mitigate risks.

What partnerships should investors consider when entering this market?

Potential partnerships could include local waste management companies, government agencies, and NGOs focused on sustainability. Collaborating with these entities can enhance operational efficiency and compliance with local regulations.

How does urbanization in Africa influence the supply of recyclable metals?

Urbanization leads to increased consumption of metal products, resulting in a higher volume of scrap metals available for recycling. As cities grow, so does the potential supply of recyclable materials, presenting lucrative opportunities for investors.

Compare

Dear investor, please compare similar category items- either Locations or Opportunities.

*Already subscribed.

*Enter your name/email.

Sign up for exclusive investment alerts.

Already subscribed? Skip

Thank You For Subscribing to

Africa For Investors.

You will be redirected to AFI’s Linkedin Profile in 10 seconds.

Stay On AFI Website